Is Trading Gambling? The Honest Answer (And How to Know Which Side You’re On)

For most people, trading IS gambling. But it doesn’t have to be. Learn the exact difference between gambling and professional trading, the warning signs to watch for, and how to build a process that keeps you on the right side.

The Real Cost of Running a Trading Bot (It’s Not Just the Bot)

The bot itself is only 40% of your total cost. Here’s the complete breakdown of running an automated trading system—including the hidden costs that kill profitability.

What to Expect in Your First 90 Days In The Trader’s Thinktank

The first 90 days determine your trajectory. Here’s exactly what happens from day one through month three—and what you should focus on to get that 62% performance improvement.

Price Action Trading in 2026: Why It Still Works When Everything Else Fails

Why pure price action methodology still outperforms indicators and AI-driven systems in 2026—and how to read market structure the way institutions do.

Group Trading Coaching vs 1-on-1 Mentorship: Which Is Actually Better?

Everyone says 1-on-1 coaching is the gold standard for learning to trade. After running both formats for a decade, I’m walking away from individual mentorship entirely—because group coaching produces better traders, faster. Here’s why the “premium” option is often the wrong choice.

Why Do Most Traders Fail to Read Market Structure? (The 4-State Framework)

Most traders see patterns. Professionals see market states. The difference between balance, imbalance, acceptance, and rejection is the edge you’ve been missing.

Why Trading Discipline Won’t Save You (And What Actually Will)

Everyone says discipline is the key to trading success. After coaching 100+ traders, I can tell you — it's not. The traders who blow up aren't undisciplined. They're disciplined about the wrong things.

From Course Collector to Consistent Trader: How to Break the Education Addiction

You own a dozen trading courses but still aren’t profitable. The problem isn’t lack of information — it’s the pattern keeping you stuck. Here’s how to break the cycle.

The Five Reference Levels That Separate Professional Futures Traders from Everyone Else

Professional traders mark the same reference levels every morning before trading. These aren't random lines—they're battle-tested price points that create high-probability opportunities. Here are the five levels you need to know.

AutoPilot Trader V3: $306,405 Profit Across 1,045 Trades — Full Backtest Results

$306,405 profit. 1,045 trades. 69.8% win rate. See the full interactive performance dashboard for AutoPilot Trader V3 — our most significant algorithm update yet. Includes Monte Carlo analysis, equity curves, and strategy breakdown.

Can You Really Make Money with Trading Bots? (Our 1-Year Test Results)

Can trading bots actually make money, or are they all scams? We ran an automated trading system for 365 consecutive days on live futures markets—no cherry-picking, no hiding losses. The results: 547 automated trades, 69% win rate, $204,515 profit, and a 2.61% max drawdown. This comprehensive analysis reveals the honest truth about automated trading, including what works, what doesn't, how it compares to other passive income strategies like dividend stocks and real estate, and why most trading bots fail. Plus, we stress-tested the system with 1,000 Monte Carlo simulations to prove it wasn't just luck. See the complete 1-year performance data and whether trading automation is worth your time and capital.

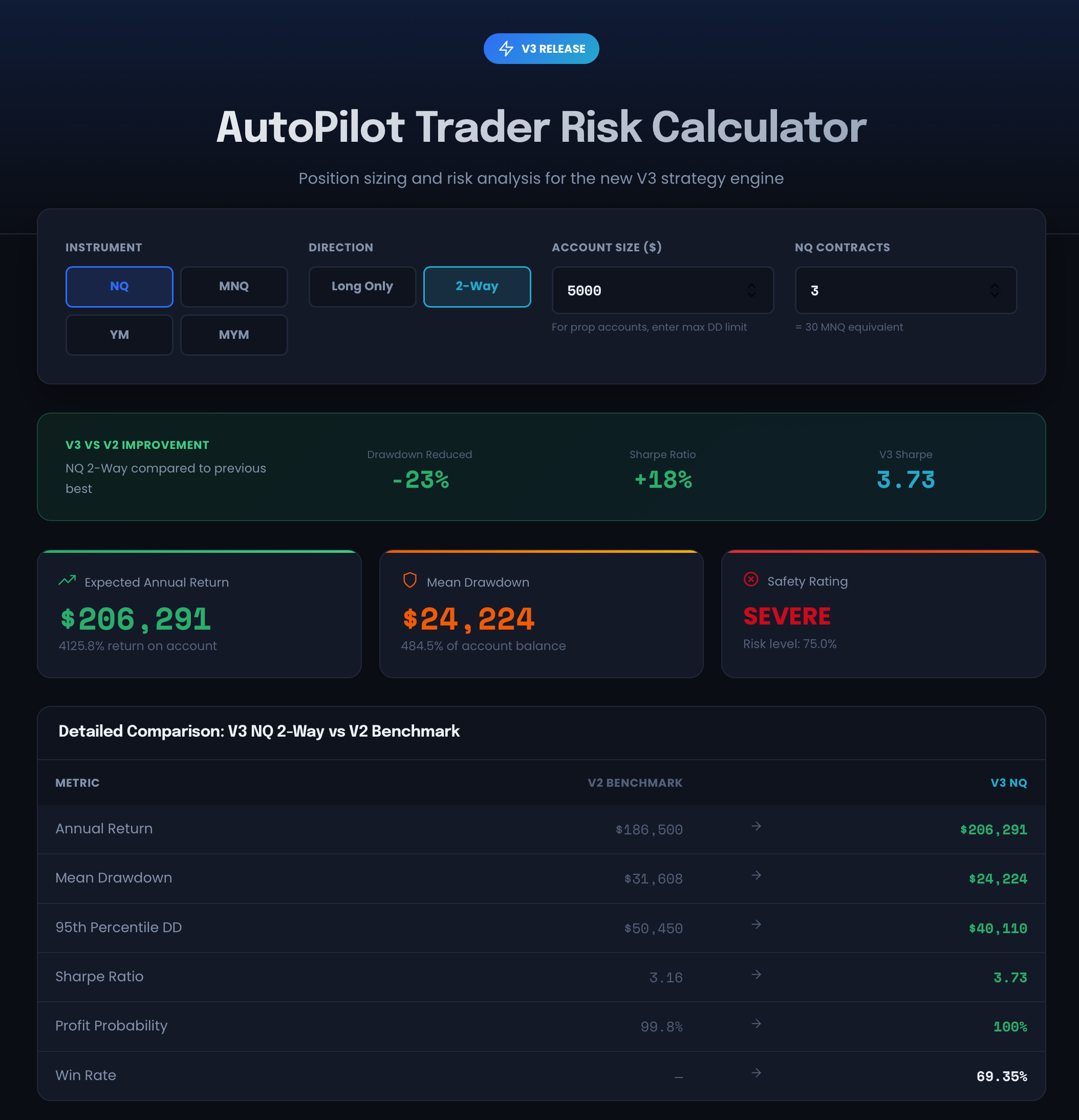

AutoPilot Trader V3: Complete Backtest Results & Performance Analysis

After 12 months of rigorous testing, AutoPilot Trader V3 delivers transformative results across multiple futures strategies. The standout performer? NQ Long-Only achieved a 4.05 Sharpe ratio with 73.5% win rate and 100% profit probability in Monte Carlo simulation. V3 introduces Long-Only modes perfect for prop firms, expands support to MNQ, YM, and MYM instruments, and dramatically improves trade quality—37% fewer trades with 21% better profit factor. This comprehensive analysis breaks down complete backtest data for all strategies including NQ, MNQ, YM, and MYM across both Long-Only and 2-Way configurations. See the equity curves, Monte Carlo results, and V2 vs V3 comparison data.

This Trading Bot Just Passed a $50K Prop Firm Eval in 18 Days (79% Win Rate)

A trading bot just passed a $50K prop firm evaluation in 18 days with a 79% win rate and 6.76 profit factor—completely hands-free. Here's what happened when strategy execution became mechanical rather than emotional, and what it means for traders struggling with consistency.

AutoPilot Trader Risk Calculator & Position Sizing Guide

Calculate optimal position size for AutoPilot Trader in 60 seconds. Free calculator using real data from 955+ trades. Includes complete guide for NQ, MNQ, YM futures & prop firm strategies.

48 Hours That Changed Everything: The AutoPilot Trader Pre-Launch Sold Out

The AutoPilot Trader pre-launch sold out in 48 hours, proving traders are ready to escape the screen-time prison. After 18 months developing my first automated strategy, the journey toward true trading freedom begins. Available now at $2,500 until November 1st.

Opinicus Holdings Evolves: Introducing Power Trading Group

We're excited to announce that Opinicus Holdings is now Power Trading Group (PTG). This strategic rebrand better reflects our mission to empower traders through education and community. While our name has evolved, everything you love about our trading programs, expert mentorship, and results-focused community remains exactly the same.

How I Turned $96.50 into $12,303 in Two Months (And Why You Probably Can't... Yet)

A transparent case study showing how $96.50 became $12,303 in two months through prop firm trading. Includes live proof, realistic expectations, and the psychological barriers most traders face.

Active vs. Passive Tilt: The Two Faces of Trading Emotion

Trading tilt manifests in two distinct patterns—aggressive active tilt and paralyzing passive tilt. Understanding which type you're prone to is crucial for building effective psychological defenses. Most traders only recognize one form while missing their vulnerability to the other.

FundedNext Payout Review: The Brutal Truth About This Prop Firm

After testing FundedNext with real money, I successfully withdrew $2,339 in under 24 hours from a 5-day trading challenge. Here's my honest review of this prop firm, including why it might not be the best choice for serious traders, plus my top recommendation with exclusive discount code.

The "Easy Money" Trade That's About to Get Even Easier

The Two Hour Trader framework has already changed hundreds of trading careers. But what we're building next will revolutionize how successful traders operate. Here's a preview.