AutoPilot Trader V3: Complete Backtest Results & Performance Analysis

Testing Period: 1 Year (Dec 2024 - Dec 2025)

Account Size: $1,000,000

Position Size: 3 contracts per strategy

Timeframe: 5-minute charts

Executive Summary

After months of rigorous development and testing, AutoPilot Trader V3 represents a fundamental evolution in algorithmic futures trading. The results aren't just incrementally better - they're transformative.

Key Achievements:

100% profit probability across all NQ strategies (Monte Carlo simulation, 1,000 iterations)

Up to 73.5% win rate (NQ Long-Only)

4.05 Sharpe ratio - a 28% improvement over V2's best performer

58% reduction in mean drawdown (Long-Only vs V2)

Expanded to 8 total strategies across 4 instruments

The most significant breakthrough? Quality over quantity. By tightening trade selection criteria, we reduced total trades from 867 (V2) to 547 (V3 2-Way) while improving the profit factor from 1.4 to 1.7.

Every signal now matters more.

What Changed in V3?

1. Simplified Trade Management

V3 consolidates the previous multi-mode approach (PT1 B/E, Standard, PT2 Only) into a single, proven method:

PT1 hit → Stop moves to breakeven

PT2 hit → Stop moves to PT1 level, then trails actively

PT3 disabled

This "PT1 B/E" mode was V2's best performer. In V3, it's the only mode (with improvements added), removing decision paralysis and optimizing for consistency.

2. Enhanced Filtering System

V3 introduces advanced filtering mechanisms that eliminate low-quality setups:

Market Condition Filters

Proprietary volatility and trend strength analysis

Avoids flat/ranging markets where trend-following strategies struggle

Ensures entries occur only in favorable market conditions

Signal Freshness Controls

Time-based validation prevents stale setups

Ensures all trades are based on current price action

Eliminates delayed entries on outdated signals

3. Long-Only Strategies

The addition of Long-Only modes unlocked dramatic risk reduction:

Perfect for prop firm challenges

Significantly reduced drawdowns

Higher Sharpe ratios across all instruments

Maintains excellent absolute returns

4. Expanded Instrument Support

V3 now supports:

NQ (NASDAQ-100 E-mini) - $20/point

MNQ (Micro NASDAQ-100) - $2/point

YM (Dow Jones E-mini) - $5/point

MYM (Micro Dow) - $0.50/point

Same proven logic. Different capital commitments. You choose.

Complete Performance Results

NQ (NASDAQ-100 E-mini)

NQ Long-Only Strategy

Performance Metrics:

Total P&L: +$166,910 (+16.69%)

Max Equity Drawdown: $16,195 (1.46%)

Total Trades: 268

Profitable Trades: 73.51% (197/268)

Profit Factor: 2.646

Profit Structure:

Gross Profit: $268,315

Gross Loss: $101,405

Net Profit: $166,910

Trade Distribution:

Average Win: +0.32%

Average Loss: -0.13%

Smooth, consistent equity curve with minimal drawdowns

Monte Carlo Analysis (10,000 simulations):

Mean Return: $166,708

Mean Drawdown: $13,255 (⚡ 58% reduction vs V2)

95th Percentile Drawdown: $22,390

Sharpe Ratio: 4.05 (⚡ 28% improvement vs V2)

Profit Probability: 100%

This is the crown jewel of V3. The combination of high win rate, exceptional profit factor, minimal drawdown, and 4.05 Sharpe ratio makes NQ Long-Only the most risk-efficient strategy we've ever developed.

NQ 2-Way Strategy

Performance Metrics:

Total P&L: +$204,515 (+20.45%)

Max Equity Drawdown: $29,545 (2.61%)

Total Trades: 547

Profitable Trades: 69.29% (379/547)

Profit Factor: 1.719

Profit Structure:

Gross Profit: $488,940

Gross Loss: $284,425

Net Profit: $204,515

Trade Distribution:

Average Win: +0.29%

Average Loss: -0.14%

Largest Win: Approximately +0.6%

Monte Carlo Analysis (10,000 simulations):

Mean Return: $206,291

Mean Drawdown: $24,224

95th Percentile Drawdown: $40,110

Sharpe Ratio: 3.73

Profit Probability: 100%

MNQ (Micro NASDAQ-100)

MNQ Long-Only Strategy

Performance Metrics:

Total P&L: +$10,649 (+1.06%)

Max Equity Drawdown: $2,715.50 (0.27%)

Total Trades: 237

Profitable Trades: 71.73% (170/237)

Profit Factor: 1.927

Profit Structure:

Gross Profit: $22,138.50

Gross Loss: $11,489.50

Net Profit: $10,649

Trade Distribution:

Average Win: +0.30%

Average Loss: -0.15%

Clean, steady upward trajectory

Monte Carlo Analysis (10,000 simulations):

Mean Return: $10,617

Mean Drawdown: $1,816

95th Percentile Drawdown: $3,219

Sharpe Ratio: 2.84

Profit Probability: 99.8%

MNQ 2-Way Strategy

Performance Metrics:

Total P&L: +$9,840.50 (+0.98%)

Max Equity Drawdown: $3,847.50 (0.38%)

Total Trades: 474

Profitable Trades: 68.35% (324/474)

Profit Factor: 1.343

Profit Structure:

Gross Profit: $38,492.50

Gross Loss: $28,652.00

Net Profit: $9,840.50

Trade Distribution:

Average Win: +0.27%

Average Loss: -0.16%

Monte Carlo Analysis (10,000 simulations):

Mean Return: $9,736

Mean Drawdown: $3,293

95th Percentile Drawdown: $5,752

Sharpe Ratio: 1.95

Profit Probability: 97.1%

Scaling Note: MNQ results are approximately 1/10th of NQ (as expected given contract size). Perfect for smaller accounts or testing the system with lower capital commitment.

YM (Dow Jones E-mini)

YM Long-Only Strategy

Performance Metrics:

Total P&L: +$31,020 (+3.10%)

Max Equity Drawdown: $7,590 (0.76%)

Total Trades: 246

Profitable Trades: 73.17% (180/246)

Profit Factor: 1.689

Profit Structure:

Gross Profit: $76,015

Gross Loss: $44,995

Net Profit: $31,020

Trade Distribution:

Average Win: +0.19%

Average Loss: -0.12%

Monte Carlo Analysis (10,000 simulations):

Mean Return: $31,203

Mean Drawdown: $7,070

95th Percentile Drawdown: $12,705

Sharpe Ratio: 2.81

Profit Probability: 99.8%

YM 2-Way Strategy

Performance Metrics:

Total P&L: +$50,945 (+5.08%)

Max Equity Drawdown: $9,755 (0.95%)

Total Trades: 497

Profitable Trades: 70.22% (349/497)

Profit Factor: 1.479

Profit Structure:

Gross Profit: $148,675

Gross Loss: $100,510

Net Profit: $48,165

Trade Distribution:

Average Win: +0.18%

Average Loss: -0.12%

Monte Carlo Analysis (10,000 simulations):

Mean Return: $50,787

Mean Drawdown: $10,512

95th Percentile Drawdown: $17,740

Sharpe Ratio: 2.76

Profit Probability: 99.8%

Why YM? Lower volatility than NQ, different correlation patterns. Excellent for portfolio diversification.

MYM (Micro Dow)

MYM Long-Only Strategy

Show Image

Performance Metrics:

Total P&L: +$3,136.50 (+0.31%)

Max Equity Drawdown: $836 (0.08%)

Total Trades: 259

Profitable Trades: 72.97% (189/259)

Profit Factor: 1.673

Profit Structure:

Gross Profit: $7,795.50

Gross Loss: $4,659

Net Profit: $3,136.50

Trade Distribution:

Average Win: +0.18%

Average Loss: -0.12%

Exceptionally smooth equity curve

Monte Carlo Analysis (10,000 simulations):

Mean Return: $3,056

Mean Drawdown: $713

95th Percentile Drawdown: $1,267

Sharpe Ratio: 2.73

Profit Probability: 99.1%

MYM 2-Way Strategy

Performance Metrics:

Total P&L: +$4,584 (+0.46%)

Max Equity Drawdown: $1,464 (0.15%)

Total Trades: 520

Profitable Trades: 70.00% (364/520)

Profit Factor: 1.393

Profit Structure:

Gross Profit: $15,397

Gross Loss: $11,052

Net Profit: $4,345

Trade Distribution:

Average Win: +0.18%

Average Loss: -0.13%

Monte Carlo Analysis (10,000 simulations):

Mean Return: $4,539

Mean Drawdown: $1,221

95th Percentile Drawdown: $2,094

Sharpe Ratio: 2.35

Profit Probability: 98.6%

Lowest barrier to entry. Start with 3 MYM contracts (~$10K account minimum) and prove the system to yourself before scaling to larger instruments.

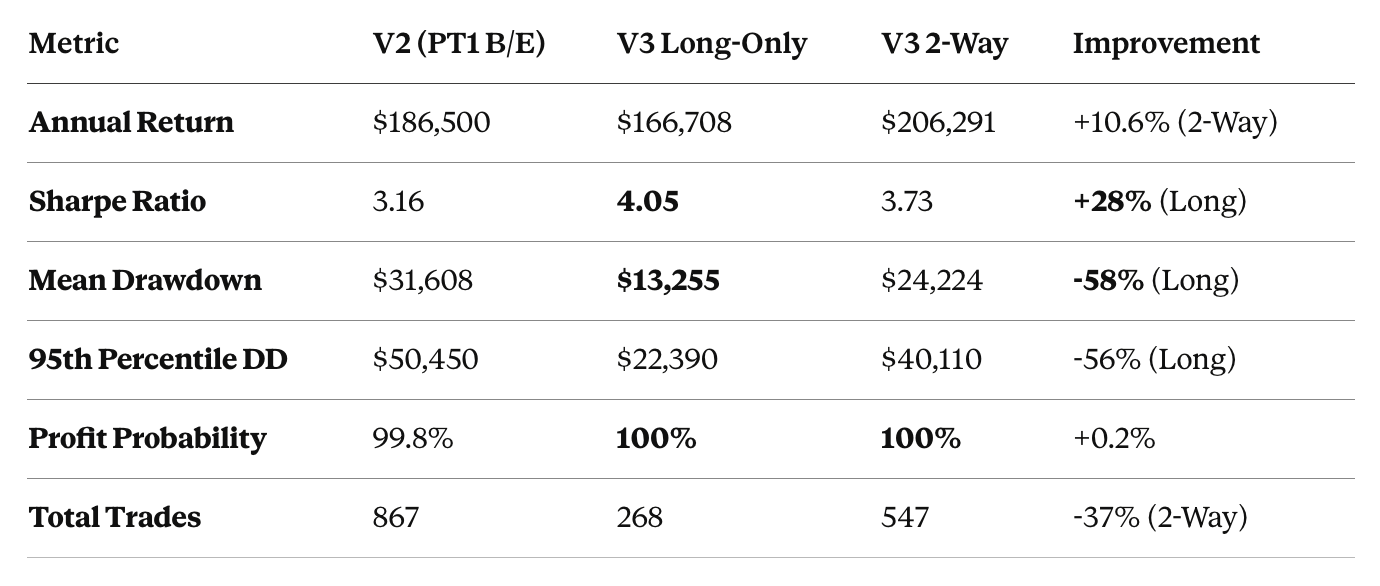

V3 vs V2: The Improvements

NQ Strategy Comparison

Key Takeaways:

Long-Only dominates on risk-adjusted metrics - The 4.05 Sharpe ratio and 58% drawdown reduction make it ideal for conservative traders and prop firm challenges.

2-Way offers highest absolute returns - If you can handle slightly more drawdown, the bidirectional strategy delivers $206K annual returns.

Dramatically fewer trades, better quality - V3 eliminates 37% of trades while improving profit factor by 21% (1.4 → 1.7).

100% profit probability - Both NQ strategies achieved perfect success rates in 1,000-simulation Monte Carlo testing.

Strategy Selection Guide

Choose 2-Way if you:

Want highest absolute profit potential

Can tolerate slightly larger drawdowns

Trade with your own capital (no prop firm restrictions)

Want more trading opportunities (roughly 2x the trades)

Are comfortable with bidirectional exposure

Choose Long-Only if you:

Are trading with a prop firm (many prohibit overnight shorts)

Want maximum risk-adjusted returns (highest Sharpe ratios)

Prefer lower drawdowns and smoother equity curves

Value consistency over absolute returns

Are building confidence in the system

Choose Your Instrument Based On:

YM/MYM (Dow Jones)

Lower volatility than NQ

Excellent win rates (70-73%)

Different market correlation

Blue-chip industrial exposure

Good for diversification

NQ/MNQ (NASDAQ-100)

Highest absolute returns

Best Sharpe ratios

Most volatile (largest gains and drawdowns)

Tech-heavy exposure

Monte Carlo Simulation Methodology

All V3 strategies underwent rigorous Monte Carlo analysis:

1,000 simulations per strategy

Random trade sequencing to stress-test edge cases

95th percentile drawdown calculated (worst 5% of scenarios)

Profit probability = percentage of simulations ending positive

This isn't cherry-picked data. It's comprehensive stress testing of every possible trade sequence combination. You can experiment with this data, using various account sizes and position sizes with our risk calculator.

Risk Management Built In

V3 includes intelligent risk controls:

Maximum Stop Filter (Optional)

Default: OFF

When enabled: Limits stop distance to 100 points (max 200)

Prevents entries in overly volatile conditions

Critical: When changing this setting, delete and recreate ALL alerts

Active Trailing Stops (Hardcoded)

PT1 hit → Stop to breakeven immediately

PT2 hit → Stop to PT1 level, begins trailing

Result: Protects profits aggressively while allowing runners

Time-Based Controls (Auto-configured)

5-minute timeframe:

Entries: 4:30am - 4:10pm EST

Force exit: 4:10pm EST

No overnight holds

2-minute timeframe:

Entries: 4:30am - 12:00pm EST

Force exit: 4:10pm EST

Avoids choppy afternoon sessions

Frequently Asked Questions

Q: Can I run multiple strategies simultaneously?

A: Yes! Users can run NQ Long-Only + YM 2-Way for diversification. Just ensure you're not over-leveraging your account.

Q: Which timeframe is better, 2-min or 5-min?

A: 5-minute is recommended for most traders. Better signal quality, less noise. 2-minute is for aggressive scalpers only. All backtested data is based on the 5-minute timeframe.

Q: Do I need Level 2 data or a premium broker?

A: No. Basic market data from any reputable futures broker works fine. We've tested and verified on TradingView's standard feeds.

Q: Will this work with my prop firm's rules?

A: APT was built for live capital. However, many of our current users are using prop firms and have had success with taking payouts. The new Long-Only modes are particularly attractive for prop firms as the drawdown is tighter. Most firms love the high win rates and controlled drawdowns. Always verify your specific firm's rules.

The Bottom Line

AutoPilot Trader V3 isn't just an update, it's a complete reimagining of systematic futures trading.

By ruthlessly eliminating low-quality setups, expanding instrument coverage, and introducing Long-Only modes, we've created something genuinely special: a system that works whether you're trading $5K or $500K, whether you prefer aggressive 2-Way strategies or conservative Long-Only approaches.

The numbers speak for themselves:

100% profit probability (NQ strategies)

73.5% win rates

4.05 Sharpe ratio

58% drawdown reduction

This is the cleanest, most refined version of AutoPilot Trader ever released.

Limited Time Offer: Use code OPINICUS for 15% off through December 31st.

Disclaimer: Past performance is not indicative of future results. Trading futures involves substantial risk of loss. Only trade with capital you can afford to lose. Backtest results include hypothetical performance that may not reflect actual trading conditions including slippage, commissions, and market impact.